- Medicare Skilled Nursing Copay 2021 Dates

- Medicare Skilled Nursing Copay 2021

- Medicare Skilled Nursing Copay 2021

- Medicare Skilled Nursing Copay 2021 Application

- Medicare Skilled Nursing Copay 2021 Form

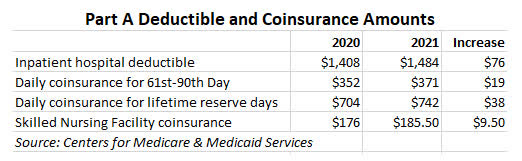

CMS also announced that the annual deductible for Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from $198 in 2020. Medicare Part A Premiums/Deductibles Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. Medicare copay changes for 2021 Sue Bailey For The Gazette Nov 16, 2020 Nov 16, 2020. Medicare Part A Skilled Nursing Facility Copay for Days 21-100 - $185.50 per day - $9.50 per day increase. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. $0 copay Routine foot care $0 copay; for each visit up to 4 visits every year Meal Benefit2 $0 copay; Meals provided 1 time per calendar year immediately after an inpatient hospital or skilled nursing facility stay. Home Health Care2 $0 copay Hospice You pay nothing for hospice care from any Medicare-approved hospice. You may have to pay part.

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met.

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

Understanding Medicare Copayments & Coinsurance

Medicare copayments and coinsurance can be broken down by each part of Original Medicare (Part A and Part B). All costs and figures listed below are for 2021.

Medicare Part A

After meeting a deductible of $1,484, Medicare Part A beneficiaries can expect to pay coinsurance for each day of an inpatient stay in a hospital, mental health facility or skilled nursing facility. Even though it's called coinsurance, it operates like a copay.

- For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance

- Days 61 to 90 require a coinsurance of $371 per day

- Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve' days

These lifetime reserve days do not reset after the benefit period ends. Once the 60 lifetime reserve days are exhausted, the patient is then responsible for all costs.

For a stay at a skilled nursing facility, the first 20 days do not require a Medicare copay. From day 21 to day 100, a coinsurance of $185.50 is required for each day. Beyond 100 days, the patient is then responsible for all costs.

Under hospice care, you may be required to make copayments of no more than $5 for drugs and other products related to pain relief and symptom control, as well as a 5% coinsurance payment for respite care.

Under Part A of Medicare, a 20% coinsurance may also apply to durable medical equipment utilized for home health care.

Medicare Part B

Once the Medicare Part B deductible is met, you may be responsible for 20% of the Medicare-approved amount for most covered services. The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare.

Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

Understanding Medicare Deductibles

Medicare Part A and Medicare Part B each have their own deductibles and their own rules for how they function.

Medicare Part A

The Medicare Part A deductible in 2021 is $1,484 per benefit period. You must meet this deductible before Medicare pays for any Part A services in each benefit period.

Medicare Part A benefit periods are based on how long you've been discharged from the hospital. A benefit period begins the day you are admitted to a hospital or skilled nursing facility for an inpatient stay, and it ends once you have been out of the facility for 60 consecutive days. If you were to be readmitted after 60 days of being home, a new benefit period would start, and you would be responsible for meeting the entire deductible again.

Medicare Part B

Medicare Skilled Nursing Copay 2021 Dates

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services.

Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

Cover your Medicare out-of-pocket costs

There is one way that many Medicare enrollees get help covering their Medicare out-of-pocket costs.

Medigap insurance plans are a form of private health insurance that help supplement your Original Medicare coverage. You pay a premium to a private insurance company for enrollment in a Medigap plan, and the Medigap insurance helps pay for certain Medicare out-of-pocket costs including certain deductibles, copayments and coinsurance.

The chart below shows which Medigap plans cover certain Medicare costs including the ones previously discussed.

Click here to view enlarged chart

Scroll to the right to continue reading the chart

Medicare Supplement Benefits

Part A coinsurance and hospital coverage

Part B coinsurance or copayment

Part A hospice care coinsurance or copayment

First 3 pints of blood

Skilled nursing facility coinsurance

Part A deductible

Part B deductible

Part B excess charges

Foreign travel emergency

Medicare Skilled Nursing Copay 2021

| A | B | C* | D | F1* | G1 | K2 | L3 | M | N4 |

|---|---|---|---|---|---|---|---|---|---|

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | ||||||||

| 50% | 75% | 50% | |||||||

| 80% | 80% | 80% | 80% | 80% | 80% |

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

+ Read more1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission.

- Read lessIf you're ready to get help paying for Medicare out-of-pocket costs, you can apply for a Medigap policy today.

Find Medigap plans in your area.

Find a planResource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

CareSource has a network of doctors, hospitals and other providers. If you use providers who are not in our network, the plan may not pay for these services unless you needed emergency services or CareSource specifically authorized the services.

Use our Find a Doctor/Provider tool to see if your doctor is in our network.

Learn more about out-of-network coverage by reviewing your Evidence of Coverage on our Plan Documents page.

2021 Copayments and Fees

| Other Medical Benefits (In-Network) | ||

| Inpatient Hospital Care | Days 1-5: $365 per day Days 6-90: $0 copay per day | Days 1-7: $285 per day Days 8-90: $0 copay per day |

| Skilled Nursing Facility (SNF) | Our plan covers up to 100 days in an SNF: Days 1-20: $0 copay Days 21-100: $184 per day | Our plan covers up to 100 days in an SNF: Days 1-20: $0 copay Days 21-100: $184 per day |

| Outpatient Hospital Services | $295 copay | $295 copay |

| Ambulatory Surgical Center | $250 copay | $250 copay |

| Diabetes Testing Supplies | $0 copay | $0 copay |

| Durable Medical Equipment (DME) | 20% coinsurance | 20% coinsurance |

| Home Health Care | $0 coinsurance | $0 coinsurance |

| Ambulance Services | $225 copay | $225 copay |

| Urgent Care | $45 copay | $35 copay |

| Emergency Care | $90 copay | $90 copay |

| Lab Services and Other Tests (In-Network) | ||

| Laboratory Tests | $35 copay | $0 – $10 copay |

| Diagnostic Tests (Non-Radiology) and Procedures | $35 copay | $0 – $10 copay |

| Diagnostic Radiology Tests (such as MRIs, CT scans) | $175 copay | $150 copay |

| Outpatient X-Rays | $50 copay | $25 copay |

Preventive Care

You pay nothing for in-network preventive care. We encourage you to take advantage of preventive services, which are covered by CareSource Medicare Advantage. We also offer CareSource24®, our 24/7/365 nurse advice line. Call the the toll-free number on your CareSource member ID card.

Prior Authorization

Some services require prior authorization from CareSource. This means your doctor or health care provider must get approval from CareSource before you can get the service.

Usually your primary care provider (PCP) will ask for prior authorization from us and then schedule these services for you. If you are seeing a specialist, he or she will get approval from your PCP. Then your services will be scheduled. If you have questions about the prior authorization process or status, please call Member Services.

Network Providers

Medicare Skilled Nursing Copay 2021

CareSource has a network of doctors, hospitals, pharmacies and other providers. In order to have your health care services covered by your plan, you must get them from a network provider.

You can find the most current list of network providers using our online search tool, Find a Doctor, under the Quick Links to the left. Select the state where you live and your health care plan to get started.

Network Exceptions

It is important to know which providers are part of our network because – with limited exceptions – while you are a member of our plan, you must use network providers to get your medical care and services. The only exceptions are:

- Emergencies

- Urgently needed services when the network is not available (generally, when you are out of the area)

- Out-of-area dialysis services

- If the Governor of your state, the U.S. Secretary of Health and Human Services, or the President of the United States declares a state of disaster or emergency in your geographic area

- Cases in which CareSource authorizes use of out-of-network providers

Please refer to the Evidence of Coverage for your plan on the Plan Documents page for full information on in-network and out-of-network copayments, as well as applicable conditions and limitations.

When You Are Outside of Our Service Area

If you get sick or hurt while traveling outside of our service area, you can get medically necessary covered services from a provider not in our network.

Prior to seeking urgent care, we encourage you to call your PCP for guidance, but this is not required.

You should get urgent care from the nearest and most appropriate health care provider. Emergency care is covered both in and out of our service area.

If you receive emergency care from a provider who is not a network provider, or urgent care services outside the service area, you will need to submit the bill you receive to CareSource with a claim form found on our Forms page. You may also obtain a claim form by calling Member Services at 1-844-607-2827(TTY: 711). We are open 8 a.m. – 8 p.m. Monday through Friday, and from October 1 – March 31 we are open the same hours 7 days a week.

Medicare Skilled Nursing Copay 2021 Application

Out-of-network/non-contracted providers are under no obligation to treat CareSource members, except in emergency situations. Please call our customer service number or see your Evidence of Coverage for more information, including the cost- sharing that applies to out-of-network services.

Medicare Skilled Nursing Copay 2021 Form

This information is not a complete description of benefits. Call 1-844-607-2827 (TTY: 711) for more information.